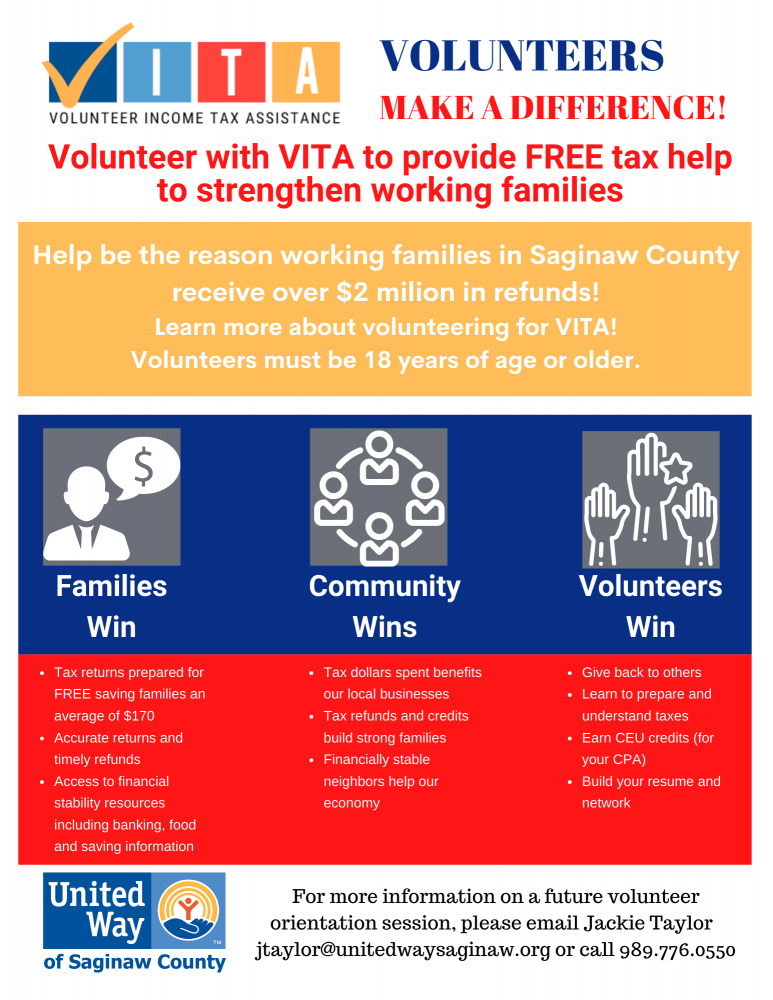

VITA Tax Assistance

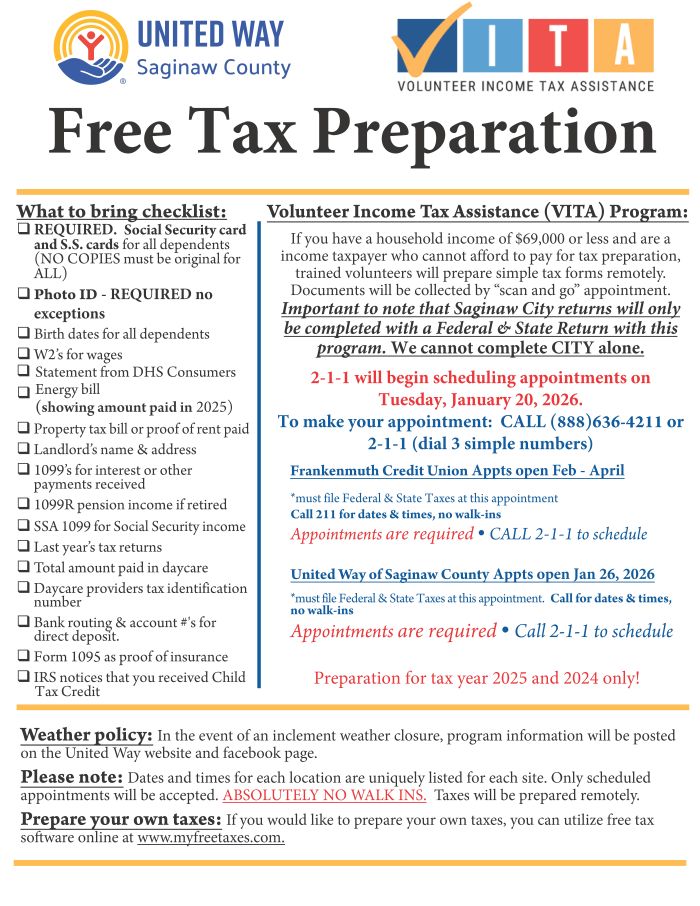

FREE Income Tax Preparation for Individuals and Households that earn $69,000 or less.

www.myfreetaxes.com

You can utilize free tax preparation software to prepare your own tax return.

IRS Free File lets you prepare and file your federal income tax online for free.